The real estate market has had an ominous cloud looming for a long while with sunshine trying to break through. Now, according to a recently released second quarter survey by HomeGain, optimism is growing and a sunnier forecast is anticipated by some.

The survey results are taken from a pool of more than 400 agents and brokers and 1,700 homeowners. Perhaps not surprisingly the optimism is a bit unequal. Regarding the general direction of home values, about 48 percent of industry professionals expect home values to increase compared to only 27 percent of homeowners. However both percentage figures are up from first quarter 2012.

The outlook for the next two years? The forecast, according to the belief of those surveyed, gets even better. Real estate professionals (82 percent) and homeowners (59 percent), both believe home values will increase in the next couple of years. However, a small percentage group, 6 percent of real estate professionals and 15 percent of homeowners, think the exact opposite.

Meanwhile, 14 percent of industry professionals are warning to prepare for yet another decrease in home values. The percentage shoots up to 24 percent of homeowners who agree with this prediction.

Forecasting no change: 38 percent of real estate professionals and 49 percent of homeowners expect home values to remain the same over the next six months.

In a press statement, Louis Cammarosano, General Manager of HomeGain said, “Optimism among real estate professionals spiked in the second quarter. Real estate professionals are optimistic about home prices in the short term and especially optimistic in the coming two years with 82 percent of real estate professionals and 59 percent of homeowners expecting prices to rise.”

But where are these anticipated increases in home values expected? The survey results show expected increases are scattered throughout the country. Here are the lists of the top 10 states where home values are expected to increase in the next six months, according to real estate professionals and homeowners.

Real estate professionals expect increases in home values in the next six months: Virginia, Arizona, Colorado, California, Texas, Florida, Massachusetts, Ohio, New York, and Georgia.

Homeowners expect increases in home values in the next six months in: Arizona, Colorado, Oregon, Texas, Pennsylvania, Virginia, Maryland, Washington, Florida, North Carolina.

As for declining home values in the next six months, real estate professionals expect the following top 10 states to get hit hardest in this order: Pennsylvania, Ohio, New York, Georgia, Maryland, Florida, Colorado, Virginia, Texas, and California.

Homeowners think the top 10 states to experience a decline in home values in the next six months will look like this: Illinois, North Carolina, California, Oregon, Georgia, New Jersey, New York, Maryland, Pennsylvania, and Florida.

Breaking down the information. If you're planning to sell your home, be sure to showcase your home's features. As buyer confidence builds in the real estate market, it's important as a seller to think like a potential buyer would. See your home from a buyer's perspective. Before you put your home on the market make it as "buyer-focused" as possible which means the following things should be implemented: de-cluttering, maintenance repair, home staging, and curb appeal. The more you make your home "buyer-focused" the greater the chances of a faster and higher priced sale. For more information read my column " Buyers Want Move-In Ready Homes. "

Tuesday, July 10, 2012

Buyer's Comfort Zone May Be a Danger Zone

The greatest obstacles to success with any goal can be our advantages. These comfort zones can be dangerous distractions when advancing toward a goal to buy a home or cottage, or to achieve any significant change in life. Your advantages can represent limitations since they offer only familiar possibilities and obvious opportunities. These aren’t necessarily the best options, most creative solutions, or ideal choices for the future.

Advantages of friendship, experience, financing, or family proximity can lure buyers to markets, locations, or price ranges which can detract from long-term goals, restrict lifestyle options, or limit return on real estate investment:

Friendship can undermine analysis and decision makingLook no further than friends for market research and real estate knowledge, and success is limited before you start. At the same time, a buyer who considers the real estate or mortgage salesperson a friend may leave more of the analysis for fit and practicality of the real estate or mortgage to the professional than is to the buyer’s advantage. Clearly-defined goals, not insecurity, short-sightedness, or plain laziness, should form the foundation for investing in real estate. Buyers who don’t take the initiative to think and act in their own best interest are vulnerable to the agendas—hidden and otherwise—of salespeople, and to sellers’ marketing campaigns and staging. If you don’t take charge of your future, others will.

In times of change, experience can be a buyer’s worst enemy>/b>Let the fear of acquiring new skills, perspectives, or knowledge paralyse you, and you’ll be trapped in your comfort zone. For first-time buyers of a house, condominium, or cottage that can be problematic as they have no ownership experience to fall back on—just hearsay based on the questionable experience of non-professionals (that’s friends and family). Buyers who have owned at least one property, may not realize how dated their experience is. A lot has happened in the last year or so, thanks to the internet and the economy. If a buyer’s real estate experience and knowledge are a decade or two old, it may put decision-making at risk or at least cause a buyer to miss out on the best the current market has to offer. Cellphones and the net don’t automatically answer your wishes like Aladdin’s Lamp. Look beyond what is easily available and beyond Google™ and Wikipedia™, to learn from the broad range of experience and wisdom of real people and creative professionals.

What can be afforded may not be all that can be bought.Even at the max pre-approved financing limit, buyers may not be able to purchase the location or type of housing they prefer. Add a rent-paying boarder or two, or a income-generating second unit to the real estate mix, and borrowing power is extended. Lenders will usually include at least half the rental income in mortgage calculations which can mean a mortgage large enough to buy that “dream home” or preferred neighbourhood. After a few years, the rental may no longer be necessary, or it could have evolved into a financial powerhouse in paying off the mortgage. Include a home-based business, and tax advantages will lower income tax while increasing cashflow. Using a mortgage broker to shop for the best mortgage package available can increase returns and expand affordability even further.

Families can mean the best of times and the worst of timesWhat the family thinks a buyer should do, may be dramatically different from what the buyer would like to achieve, or it may be more than the buyer is ready to commit to. Add to this, the pressure to move near family, and you have buyers who are paying the mortgage on a house or condominium that may not really be their first choice. Purchase a property for family convenience or under pressure from others, and the independence that comes with real estate ownership is compromised from the beginning. If you don’t reach beyond what family thinks you can do because they know you so well, how will you discover that brilliant future that can lie ahead?

The major limiting factor in buying real estate is not what the market is doing, but how creatively buyers can achieve the goals that matter to them. Play follow the leader and do what your friends are doing, and you’ll end up with what they’ve all settled for. Expand your thinking by learning more about where personal value lies and how to be a savvy buyer, and you’ll end up with more home, a more affordable mortgage, and less wasted money.

Advantages become strengths when they are consciously used as bridges to overcome disadvantages. If you don’t move out of comfort zones, you’re in danger of never discovering what you’re missed.

Advantages of friendship, experience, financing, or family proximity can lure buyers to markets, locations, or price ranges which can detract from long-term goals, restrict lifestyle options, or limit return on real estate investment:

The major limiting factor in buying real estate is not what the market is doing, but how creatively buyers can achieve the goals that matter to them. Play follow the leader and do what your friends are doing, and you’ll end up with what they’ve all settled for. Expand your thinking by learning more about where personal value lies and how to be a savvy buyer, and you’ll end up with more home, a more affordable mortgage, and less wasted money.

Advantages become strengths when they are consciously used as bridges to overcome disadvantages. If you don’t move out of comfort zones, you’re in danger of never discovering what you’re missed.

Pending home sales index rises in May, up 13.3% from 2011

WASHINGTON – Americans signed more contracts to buy previously occupied homes in May, matching the fastest pace in two years.

Matt Rourke, AP

A sign for a home under contract. File photo.

Sponsored Links

The increase suggests home sales will rise this summer and the modest housing recovery will continue.

The National Association of Realtors said Wednesday that its index of sales agreements increased to 101.1 last month from 95.5 in April. That matches March's reading, the highest since April 2010, when a home-buying tax credit boosted sales.

A reading of 100 is considered healthy. The index is 13.3% higher than it was a year ago. It bottomed at 75.88 in June 2010, after the tax credit expired.

Contract signings typically indicate where the housing market is headed. There's a one- to two-month lag between a signed contract and a completed deal.

Recent data suggest the housing market has started to recover more than five years after the bubble burst.

Home prices rose in 19 of 20 major U.S. cities in April from March, according to the Standard & Poor's/Case-Shiller index, released Tuesday. A measure of national prices rose 1.3% in April, the first increase in seven months.

Sales of new and previously occupied homes are up over the past year, in part because mortgage rates have plunged to the lowest levels on record. Builders are more confident and are starting to build more homes.

New home sales jumped in May to the fastest pace in more than two years. Sales of previously occupied homes fell last month, after nearly touching a two-year high in April. Still, re-sales have risen 9.6% in the past 12 months.

The supply of homes for sale remains extremely low. That has helped stabilized prices and could push them higher.

The inventory of existing homes for sale is back down to levels last seen in 2006. And there were 145,000 new homes for sale in May, just 1,000 higher than April, which was the lowest supply on records dating back to 1963.

Despite modest gains in housing, the broader economy has weakened in recent months. Employers have added an average of only 73,000 jobs a month in April and May. That's much lower than the average of 226,000 added in the first three months of this year. Some economists worry that the sluggish job market could weigh on home sales just as the housing market is flashing signs of recovery.

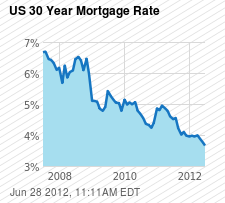

Thirty-year mortgage rate stays at record low 3.66%

WASHINGTON – The average U.S. rate on the 30-year fixed mortgage stayed this week at the lowest level on record. Cheap mortgages have helped drive a modest housing recovery and could give the broader economy a jolt at a time when the job market is weak.

Sponsored Links

Mortgage buyer Freddie Mac says the average on the 30-year loan was 3.66%. That's unchanged from last week and the lowest since long-term mortgages began in the 1950s.

The average rate on the 15-year mortgage, a popular refinancing option, slipped to 2.94%. That's down from 2.95% last week and matches the record-low 2.94% reached three weeks ago.

The rate on the 30-year loan has been below 4% since December.

Cheap mortgages have provided a lift to the long-suffering housing market. Sales of new and previously occupied homes are up from the same time last year. Home prices are rising in most markets. And homebuilders are starting more projects.

The number of people who signed contracts to buy previously occupied homes rose in May, matching the fastest pace in two years, the National Association of Realtors reported Wednesday. That suggests Americans are growing more confident in the market.

National Mortgage Rates

| |||||||||||||||||||||||||

Low rates could also provide some help to the economy if more people refinance. When people refinance at lower rates, they pay less interest on their loans and have more money to spend. Many homeowners use the savings on renovations, furniture, appliances and other improvements, which help drive growth.

Still, the pace of home sales remains well below healthy levels. Many people are still having difficulty qualifying for home loans or can't afford larger down payments required by banks.

And the sluggish job market could deter some would-be buyers from making a purchase this year. The U.S. economy created only 69,000 jobs in May, the fewest in a year. The unemployment rate rose to 8.2% last month, up from 8.1% in April.

Mortgage rates have been dropping because they tend to track the yield on the 10-year Treasury note. Uncertainty about how Europe will resolve its debt crisis has led investors to buy more Treasury securities, which are considered safe investments. As demand for Treasuries increase, the yield falls.

And the yield will likely fall even lower now that the Federal Reserve has said it will continue selling short-term Treasuries and using the proceeds to buy longer-term Treasuries. That goal of the program is to drive long-term interest rates lower to encourage more borrowing and spending.

To calculate average rates, Freddie Mac surveys lenders across the country on Monday through Wednesday of each week.

The average does not include extra fees, known as points, which most borrowers must pay to get the lowest rates. One point equals 1% of the loan amount.

The average fee for 30-year loans was 0.7 point, unchanged from last week. The fee for 15-year loans also was 0.7 point, up from 0.6.

The average rate on one-year adjustable rate mortgages was unchanged from last week at 2.74%. The fee for one-year adjustable rate loans slipped to 0.4 point from 0.5 point.

Remodelers turn to paint, porches to update home exteriors

When Darci and Matt Haney saw the "for sale" 1938 cottage a few blocks from where they were living in Carlton, Ore., they fell in love with its architecture.

Susan Seubert, for 'This Old House'The Haneys of Carlton, Ore., boosted their curb appeal with new plants, a gravel path, landscape lights and heftier porch posts.

Susan Seubert, for 'This Old House'The Haneys of Carlton, Ore., boosted their curb appeal with new plants, a gravel path, landscape lights and heftier porch posts.

Susan Seubert, for 'This Old House'

The Haneys of Carlton, Ore., boosted their curb appeal with new plants, a gravel path, landscape lights and heftier porch posts.

Sponsored Links

"It was pretty overgrown," recalls Darci Haney, who runs a small design company. They bought it anyway and began clearing the space to restore the two-bedroom's exterior charm.

"We did the work ourselves," she says, including new plantings, a gravel path, landscape lighting and heftier porch posts. They repaired and painted the cedar siding but spent the bulk of the project's cost, $25,000 to $30,000, on a new roof and energy-efficient windows.

"We absolutely love it. There's nothing we would change," Haney says of the renovation, completed last summer.

As more Americans remodel existing homes, rather than move to new ones, they're maximizing not only their renovation budgets but also their entire property.

"People are going back to the front of the house," to entertain and relax, says Amy Hughes, features editor ofThis Old House magazine. "It's kind of a throwback." As part of that trend, she says, more people are restoring or adding front porches.

She welcomes the effort, saying, "the entry is the handshake of your home," whether it's a beautiful porch, walkway or front door. She says homeowners can create an inviting entry simply by adding light sconces on each side of the front door and using window boxes, pathway lighting or hanging planters.

"We encourage people to sweat the small stuff," she says, adding it can be inexpensive and have "a huge payoff" in both curb appeal and homeowner satisfaction.

"If you don't like the look of your house, it can markedly color your life within its walls," says architect Sarah Susanka in her book, Not So Big Remodeling, published by Taunton. "Even if you don't really need to change the exterior, give yourself permission to consider giving it a prettier face."

Try lipstick. If people have little to spend, she suggests they paint the window sashes, or the storm windows, a strong color. "I call this the 'lipstick' approach, because it has the same effect as makeup on a face," she says, noting that it draws attention to one small element and makes the whole look more appealing as a result.

Kimberly Lacy, a designer on HGTV's Curb Appeal: The Block, agrees. She encourages homeowners to use color and says the front door is often a good place to make a statement. She recommends they pick a hue that complements either the house's exterior, its landscaping or its neighborhood.

"That's the perfect place to be brave, because it's just a quart of paint" and can be easily changed, says Jackie Jordan, director of color marketing at Sherwin-Williams. She says red, blue, green, brown and black are popular. More daring favorites: deep plum, purple, burnt orange.

Hughes says she's even seeing tangerine, teal and yellow. "You can take risks and do a lime-green door if the rest of the house is subdued," she says. "But don't think of the door alone."

She says exterior colors should call out interesting details but match the intensity of neighboring homes, adding, "You don't want to be the sore thumb."

In exterior makeovers, Hughes says Americans are using more manmade, weather-resistant materials such as PVC trim, fiber-cement siding, fiberglass doors and Trex decking. She says they've become less expensive and better looking.

Housing recovery hindered by negative equity

Scott Andresen would love to sell his Seattle house. He just can't afford to.

Andy King, for USA TODAY

Mike Resop, left, finishes sodding his home June 25 in New Market, Minn.

Sponsored Links

The 41-year-old policeman and his wife, Rebecca, an environmental consultant, bought the house six years ago. Because of falling prices, they now owe at least $25,000 more on it than it's worth.

The couple would like to move to a better neighborhood with better schools for their children, ages 7 and 4. But they'd have to write a check to cover the difference.

"We can't get out, because it would be too expensive," Andresen says. "It's very frustrating."

Homeowners like the Andresens inhabit just about every housing market nationwide, and their reluctance to sell is having an unexpected impact on the U.S. housing market, which is showing signs of stabilizing after years of declining prices.

Rather than a housing market defined by weak demand and falling prices, the market is now being hampered by a restricted supply of homes for sale as demand improves. That's leading to multiple offers in dozens of markets, rising prices in some and a more volatile housing recovery than many expected.

"When you get (houses priced) under $125,000, it's like a frenzy," said Linda Schlitt-Gonzalez, owner-broker of aColdwell Banker franchise in Vero Beach, Fla. "It's not unusual to have five offers."

Negative equity, also known as being underwater, is a big part of the issue. Nationwide, almost three of 10 homeowners with mortgages have no equity in their homes or less than 5% equity, says market researcher CoreLogic. Those homeowners would have to write a check in a traditional sale, so many are not selling. Other homeowners, seeing prices rise or stabilize after falling for six years, are holding out for more price increases, Realtors and real estate experts say.

"We thought, if demand was there, there would always be sellers. But instead the supply is sitting on the sidelines," says Stan Humphries, economist for real estate website Zillow. "The inventory phenomenon … will make for a more volatile housing recovery than what we initially expected," he says.

Prices in certain markets may rise faster than expected, given shortages of homes for sale, then level off when homeowners and home builders add to supplies and banks unload more financially distressed properties, Humphries says. He had expected home prices to stop declining, then level off for years before trending up.

The nation had a 6.6-month supply of homes for sale in May, the National Association of Realtors reported. That's considered a balanced market. But NAR also reported "broad-based shortages" of lower-priced homes for sale in much of the country outside of the Northeast, "extremely tight" supplies in most price ranges in the West and "widespread" inventory shortages in much of Florida.

Of the 18 major markets tracked by real estate brokerage Redfin, 10 had less than a three-month supply of homes for sale in May. Those included Seattle, Phoenix, Denver, Sacramento, the San Francisco Bay Area, Washington, D.C., and parts of Southern California.

Tara and Steve Andersen are seeing the low inventory up close.

They're not selling their Southern California home, because they can't find anything to buy. Their town, Placentia, now has just a one-month supply of homes for sale, says data tracker ReportsOnHousing.com.

The Andersens started looking a year ago to move from their 2,100-square-footer into a bigger house with a pool. "We were looking for the house we wanted to live in forever," says Tara Andersen, 43, a professional fundraiser and mother of four.

With low interest rates, "We figured it was a good time to do that," she says. They estimate they have almost $200,000 in equity in their $550,000 home, which they've owned for 12 years.

The couple bid on a handful of homes, but each received about a dozen offers, Andersen says. Meanwhile, "prices have inched up," she says, and some homes have moved out of their price range.

Rather than move, the couple are considering adding a pool to their home. "We're feeling kind of stuck," Andersen says.

Phoenix hit hard

The impact of limited home supplies may be most evident in Phoenix, a major market that was pummeled by foreclosures.

In April, Phoenix-area home prices were up 9% year-over-year, according to Standard & Poor's Case-Shiller home price data. Nationally, prices were down 1.9%.

The Phoenix region had 50% fewer homes for sale in May than it did a year earlier, says Michael Orr, real estate expert at Arizona State University. Nationally, the May year-over-year drop was 20%, NAR says.

For homes under $250,000, buyer competition is intense. Multiple offers are common. One home recently got 95 offers, Orr says, and sold for 17% above its listing price.

Orr says Phoenix prices may level off during the hot summer months, when buying activity typically slows.

Phoenix-area foreclosures are also going up as banks work through more distressed loans in the wake of a national settlement earlier this year between state and federal officials and major mortgage servicers, Orr says. That will increase supplies, too.

Nationwide, the flow of bank-owned homes coming to market slowed 18 months ago, adding to the inventory crunch, but it may pick up again, as it has in Phoenix.

Fears that banks will flood the market with foreclosed homes, however, have been "scaled back," given that they haven't so far and that they are modifying more distressed loans, says Herb Blecher, senior vice president of mortgage tracker LPS Applied Analytics.

"Its good for prices to go up, but you see crazy things happening," Orr says. "In order for us to see a more stable housing recovery, the basic rule of economics requires prices to change enough to bring a new wave of sellers on the market."

Many of those prospective sellers are sitting tight — and may be for a while.

Less than 20% equity

Nationwide, 45% of home-loan borrowers have less than 20% equity in their homes, CoreLogic says. Sellers would generally need at least 20% equity to generate enough cash to turn around and buy a similar or larger home using a conventional loan.

If people owe 25% or more on homes than they're worth, they may not be right-side-up again for a decade, says Sam Khater, CoreLogic economist.

Supplies are shortest in markets where more homeowners are underwater, CoreLogic says.

It recently analyzed underwater borrowers and housing supplies in the nation's 50 largest metropolitan areas.

In those where more than half of the home-loan borrowers were underwater, the supply averaged 4.7 months in March. In markets with less than 10% of underwater borrowers, supplies averaged 8.3 months, CoreLogic says.

"Over time, (home) prices will increase and lift people out of debt," Khater says. "But the scale of this is too large for anything but time to cure."

Is the time right?

Rob Oyler, 42, a fiber optics executive in a suburb of Kansas City, Mo., is pondering whether time is on his side.

He and his wife, Leigh Ann, have owned their home for 10 years. They're considering selling so they can buy a bigger home for the family of five.

Interest rates, which last week averaged 3.66% for a 30-year fixed-rate loan, have enticed them to think about leaving a beloved home and neighborhood.

But they haven't taken the plunge. They suspect they'd get $20,000 less for their home than they put into it.

"We'd hate to take a loss on this house unless I know I'm getting a deal on a bigger one," Oyler says. "At the same time, interest rates have nowhere to go but up, and I worry that, if we don't sell, I'll be kicking myself in five years."

While the Oylers and Andersens have equity in their homes, Eric Berto does not.

He and his wife, Kelci, bought their home in Kent, Wash., almost four years ago. They thought they'd bought at the bottom of the market.

"We were seriously wrong," says Berto, 31, who works in public relations. The couple estimate they could get $250,000 for the home they bought for $100,000 more.

Berto is pursuing a lower interest rate loan so they can turn the house into a cash-flow-positive rental and still buy another home.

"Right now, we're operating under the assumption that the house will never again be worth $350,000," Berto says.

The dwindling inventories aren't confined to once-red-hot markets that took the biggest price declines.

In Minneapolis, inventories of available homes are down to a 4.5-month supply, says Barb Jandric, president of Edina Realty, the largest brokerage firm in the Twin Cities.

Mike and Annie Resop tested the market in January, putting their 2,500-square-foot suburban Minneapolis home on the market.

They listed it at the "high end," $269,000, Mike Resop, 31, says. They purchased it in 2008 for $250,000. No offers came. They considered lowering the price.

Annie, an administrative assistant, and Mike, a truck driver, made a list of the pros and cons of selling. They'd leave a great neighborhood and good friends. But they'd buy a place with more land and a nicer backyard.

They decided not to sell. The couple have since made closer friends in the neighborhood. Instead of being excited about someplace new, they're excited to improve their home.

"We're happy to stay put," Resop says.

Subscribe to:

Posts (Atom)