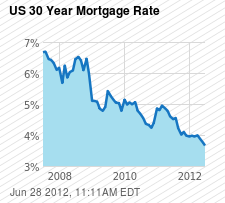

WASHINGTON – The average U.S. rate on the 30-year fixed mortgage stayed this week at the lowest level on record. Cheap mortgages have helped drive a modest housing recovery and could give the broader economy a jolt at a time when the job market is weak.

Justin Sullivan, Getty Images

A ''sale pending'' sign is posted in front of a home on June 7, 2012, in San Francisco, Calif.

Sponsored Links

Mortgage buyer Freddie Mac says the average on the 30-year loan was 3.66%. That's unchanged from last week and the lowest since long-term mortgages began in the 1950s.

The average rate on the 15-year mortgage, a popular refinancing option, slipped to 2.94%. That's down from 2.95% last week and matches the record-low 2.94% reached three weeks ago.

The rate on the 30-year loan has been below 4% since December.

Cheap mortgages have provided a lift to the long-suffering housing market. Sales of new and previously occupied homes are up from the same time last year. Home prices are rising in most markets. And homebuilders are starting more projects.

The number of people who signed contracts to buy previously occupied homes rose in May, matching the fastest pace in two years, the National Association of Realtors reported Wednesday. That suggests Americans are growing more confident in the market.

National Mortgage Rates

| |||||||||||||||||||||||||

Low rates could also provide some help to the economy if more people refinance. When people refinance at lower rates, they pay less interest on their loans and have more money to spend. Many homeowners use the savings on renovations, furniture, appliances and other improvements, which help drive growth.

Still, the pace of home sales remains well below healthy levels. Many people are still having difficulty qualifying for home loans or can't afford larger down payments required by banks.

And the sluggish job market could deter some would-be buyers from making a purchase this year. The U.S. economy created only 69,000 jobs in May, the fewest in a year. The unemployment rate rose to 8.2% last month, up from 8.1% in April.

Mortgage rates have been dropping because they tend to track the yield on the 10-year Treasury note. Uncertainty about how Europe will resolve its debt crisis has led investors to buy more Treasury securities, which are considered safe investments. As demand for Treasuries increase, the yield falls.

And the yield will likely fall even lower now that the Federal Reserve has said it will continue selling short-term Treasuries and using the proceeds to buy longer-term Treasuries. That goal of the program is to drive long-term interest rates lower to encourage more borrowing and spending.

To calculate average rates, Freddie Mac surveys lenders across the country on Monday through Wednesday of each week.

The average does not include extra fees, known as points, which most borrowers must pay to get the lowest rates. One point equals 1% of the loan amount.

The average fee for 30-year loans was 0.7 point, unchanged from last week. The fee for 15-year loans also was 0.7 point, up from 0.6.

The average rate on one-year adjustable rate mortgages was unchanged from last week at 2.74%. The fee for one-year adjustable rate loans slipped to 0.4 point from 0.5 point.

No comments:

Post a Comment